The Maiden Holdings Saga: From Financial Turmoil to Legal Battles

This article examines the strategic shift and financial turmoil of Maiden Holdings, a Bermuda-based reinsurance company, focusing on the critical role of its relationship with AmTrust Financial Services, its significant financial losses, and the ensuing legal and regulatory consequences.

1) Company Profile and the AmTrust Quota Share Contract

Maiden Holdings, Ltd. was a holding company that specialized in providing reinsurance solutions, primarily to regional and specialty insurers in the United States and Europe.

A cornerstone of Maiden’s business was its Amended and Restated Quota Share Agreement with AmTrust Financial Services, Inc., which began in 2007. Under this arrangement, AmTrust ceded a portion of its premiums to Maiden, who in turn was obligated to compensate AmTrust for a portion of its claims. Initially, Maiden reinsured 40% of AmTrust’s written premium (net of commissions or unaffiliated reinsurance) and 40% of related losses. This share could decline over time as AmTrust expanded into new lines and Maiden selectively chose not to participate in all of them.

At times, this contract accounted for more than 70% of Maiden’s net premiums earned.

The diverse portfolio of business included:

◦ Small Commercial Business: primarily U.S. workers’ compensation and commercial package lines. This also expanded to include general liability, umbrella liability, professional liability, and cyber liability.

◦ Specialty Risk and Extended Warranty: covering consumer and commercial goods and custom-designed coverages in the U.S. and Europe. This segment also included the European hospital liability business.

◦ Specialty Program: encompassing workers’ compensation and other commercial coverages for narrowly defined classes of risk, including commercial auto liability and excess and surplus lines programs.

◦ Retail Commercial Package Business was added on June 11, 2008.

AmTrust initially received a ceding commission of 31% of ceded written premiums. For the Specialty Program portion of the business, AmTrust was responsible for ultimate net loss if Maiden’s loss ratio (inception to date from July 1, 2007) was between 81.5% and 95%. Outside this corridor, Maiden continued to reinsure losses at its proportional 40% share. In July 2019, this loss corridor was amended to a maximum coverage of $40,500.

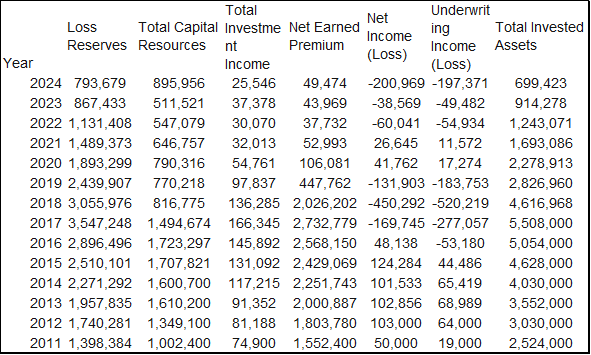

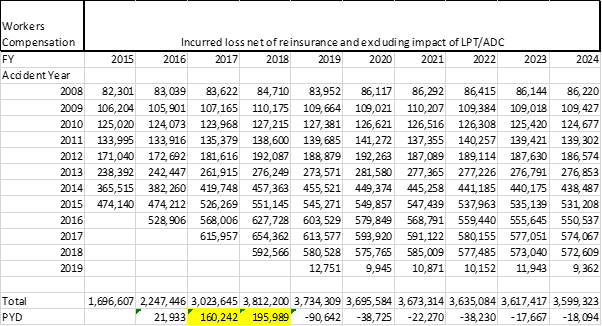

The table (figures in 000’s of US dollars) shows that the company experienced a significant decline in its business and profitability starting in 2017. The AmTrust quota share contract was subsequently terminated on a run-off basis, effective January 1, 2019. Effective July 31, 2019, Maiden entered into an LPT/ADC Agreement with Cavello Bay Reinsurance Limited (a subsidiary of Enstar Group Limited). Under this agreement, Cavello assumed $600.0 million of AmTrust Quota Share loss reserves as of December 31, 2018, in excess of a $2.2 billion retention, in exchange for a $445.0 million retrocession premium. This provided Maiden with $155.0 million in adverse development cover. The LPT/ADC Agreement specifically covers all lines of business in the AmTrust Quota Share, except for the European Hospital Liability business.

The table (figures in 000’s of US dollars) shows that the company experienced a significant decline in its business and profitability starting in 2017. The AmTrust quota share contract was subsequently terminated on a run-off basis, effective January 1, 2019. Effective July 31, 2019, Maiden entered into an LPT/ADC Agreement with Cavello Bay Reinsurance Limited (a subsidiary of Enstar Group Limited). Under this agreement, Cavello assumed $600.0 million of AmTrust Quota Share loss reserves as of December 31, 2018, in excess of a $2.2 billion retention, in exchange for a $445.0 million retrocession premium. This provided Maiden with $155.0 million in adverse development cover. The LPT/ADC Agreement specifically covers all lines of business in the AmTrust Quota Share, except for the European Hospital Liability business.

2) Financial Losses and Consequences

Maiden Holdings’ financial challenges stemmed from “significant adverse loss development” within its AmTrust Reinsurance segment, particularly from 2017 to 2018. The numbers above tell the story of a dramatic strategic shift at Maiden Holdings. The company transitioned from a major reinsurance player to a business in “run-off,” a process of winding down its old portfolios.

2015–2017: This period was the peak of Maiden’s traditional reinsurance business. The company consistently earned over 2 billion in premiums each year and was profitable in 2015 and 2016. However, the first signs of trouble appeared in 2017 with a significant net loss, signaling mounting challenges in its underwriting performance.

2018–2019: These were the most difficult years for Maiden. The company recorded its largest-ever losses, particularly the loss in 2018. The company was compelled to increase its deficient loss reserves in 2017 and 2018. The CEO stated that these actions were an “aggressive response to observed development” in the AmTrust business.

The consequences of these losses were severe: Maiden lost hundreds of millions of dollars. Its stock price plummeted from $16.50 per share in February 2017 to under $2.50 in November 2018. The company could no longer assure investors it would return to profitability. In November 2017, S&P lowered its ratings for Maiden Bermuda to ‘BBB’ (negative outlook), and Maiden Holdings’ senior debt to ‘BB+’. S&P ratings were subsequently withdrawn at Maiden’s request. Further Maiden Bermuda failed to meet its ECR as of September 30, 2018, and December 31, 2018. Capital injections of $125.0 million in December 2018 and $70.0 million in January 2019 from Maiden Holdings and Maiden NA were made to remediate

This was primarily driven by adverse reserve development from its core reinsurance business, which proved to be far more costly than initially projected. In response, the company’s earned premiums plummeted as it began terminating key reinsurance treaties and pivoting to its run-off strategy.

2020–2024: This period shows the company’s run-off strategy in action. The earned premiums dropped to an annual average of less than 50 million as the company’s focus shifted from underwriting new business to managing its existing liabilities. Effective March 16, 2020, Maiden Reinsurance re-domesticated from Bermuda to the State of Vermont in the U.S.. This was done to better align its operations, capital, and resources with its liabilities, which largely originated in the U.S., creating a more efficient structure. While the company returned to profitability in 2020 and 2021, driven by gains from its strategic repositioning and asset sales, this trend was not sustainable. In 2024, Maiden reported a substantial loss primarily due to continued adverse development on its legacy reserves, confirming the ongoing challenges of its run-off portfolio.

Maiden Holdings, Ltd. has had the following independent auditors over the years:

• BDO USA, LLP served as the independent registered public accounting firm for Maiden Holdings, Ltd. for the years ended December 31, 2013, 2014, 2015, and 2016

• Deloitte Ltd. became the independent registered public accounting firm for Maiden Holdings, Ltd. starting in 2017. They continued in this role for the years ended December 31, 2017, 2018, and 2019.

• Ernst & Young LLP has served as the independent registered public accounting firm for Maiden Holdings, Ltd. since 2020.

3) Reserve Strengthening

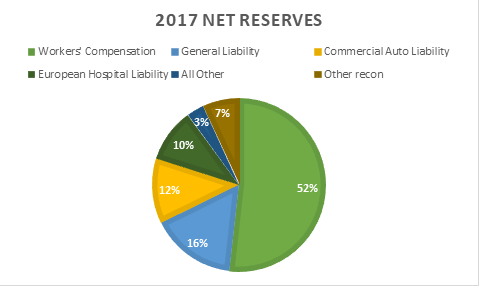

The AmTrust Reinsurance segment primarily consisted of two contracts: the European Hospital Liability Quota Share and the larger AmTrust Quota Share, which includes most other covered business. The reserve composition as of end of financial year in 2017 for this segment:

Based on the company annual reports generally, a weighted approach was used for estimating the ultimate cost of claims:

• Primarily the Loss Development (LD) method for aspects with ample historical data.

• Considering the Expected Loss Ratio (ELR) method or Bornhuetter-Ferguson (BF) method for exposure from recent acquisitions or with more limited experience.

• The Frequency-Severity (FS) method is also considered for segments where claim count information is available.

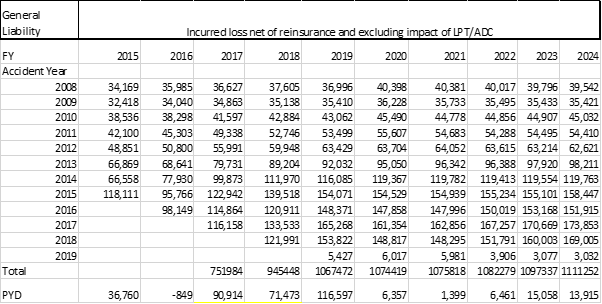

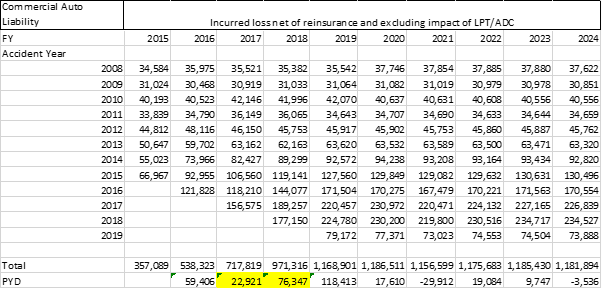

Claims development statistics can show how the estimated ultimate cost of claims changes over time. The estimated ultimate cost of claims represents what insurers expect a group of claims to cost by the time they are finalised, based on both estimated and actual costs. It can take many years for reinsurers to assess, process and pay claims. The accident year is the year in which an event giving rise to a claim occurred, regardless of when it was reported to the reinsurer.

The calculated reserve releases/strengthening shown in tables below is calculated by taking the difference between figures in columns. For example, the $160.2 million reserve increase in Workers Compensation for financial year 2017 relates to the increase in ultimate losses for all accident years prior to 2017.

Each column represents the latest estimates of net ultimate cost as of end of financial year( numbers in USD 000’s)

A significant proportion of the adverse development in the AmTrust Reinsurance segment in 2017 and 2018 came from Workers’ Compensation, which is the largest line of business in that segment. In summary, reserve strengthening in the 2017 and 2018 years was mainly a result of adverse loss development, particularly in the AmTrust Reinsurance segment, affecting lines like workers’ compensation, general liability, and commercial auto, and influenced by industry trends and internal claims operations.

While Maiden had loss-sensitive features in some contracts, these did not fully prevent adverse development. Earlier renegotiation of terms, implementing stricter loss corridors, or initiating exit strategies for consistently underperforming segments of the AmTrust relationship could have limited exposure. Maiden eventually terminated the AmTrust Quota Share and European Hospital Liability Quota Share effective January 1, 2019

4) Legal Challenges

The financial turmoil also led to legal battles. A securities fraud class action lawsuit was filed against Maiden and its executives. The plaintiffs alleged that the company’s public announcements regarding its loss reserves were misleading because they omitted historical data that showed a consistent trend of increasing losses and loss ratios on the AmTrust business. The lawsuit claimed that Maiden failed to disclose that several years had loss ratios exceeding the 69% profit threshold.

The case was initially dismissed by the district court, which held that the omissions were not “material” to investors. The lower court ruled that Maiden’s statements were not misleading because the company had considered the undisclosed historical data. It also stated that the historical data the company withheld did not “totally eclipse” all the other factors that went into their financial predictions. The legal documents acknowledge that Maiden employed a team of actuaries to estimate its loss reserve needs, but the core of the legal dispute is whether management properly used and disclosed the actuaries’ work and the historical data available to them.

However, in August 2025, the U.S. Court of Appeals for the Third Circuit reinstated the lawsuit. The appellate court ruled that the district court had applied an overly strict standard and that a jury should decide whether the omitted adverse historical data would have been important to a reasonable investor. The case was sent back to the district court for full discovery- meaning they can now get the information and evidence they were previously denied and further proceedings.

Sources

Company Form 10-K

https://www.dandodiary.com/2025/08/articles/securities-litigation/insurer-loss-reserves-and-securities-suit-omissions-allegations/#:~:text=The%20complaint%20as%20amended%20essentially,filed%20motions%20for%20summary%20judgment.

https://www.dandodiary.com/2025/08/articles/securities-litigation/insurer-loss-reserves-and-securities-suit-omissions-allegations/#:~:text=Record%20evidence%20suggests%20for%20the,from%2050%25%20to%2060%25.

https://www.investmentnews.com/regulation-and-legal-cases/maiden-holdings-securities-fraud-case-revived-around-questions-of-materiality-and-alleged-misleading-of-institutional-investors/261819#:~:text=The%20plaintiffs%20allege%20Maiden’s%20executives,per%20share%20in%20November%202018.

https://caselaw.findlaw.com/court/us-3rd-circuit/117620445.html#:~:text=Plaintiff%2Dappellants%20Boilermaker%20Blacksmith%20National,that%20Maiden%20committed%20securities%20fraud.

https://www.investmentnews.com/regulation-and-legal-cases/maiden-holdings-securities-fraud-case-revived-around-questions-of-materiality-and-alleged-misleading-of-institutional-investors/261819#:~:text=The%20District%20Court%20granted%20summary,considerations%20used%20to%20set%20reserves.

https://www.jdsupra.com/legalnews/third-circuit-reinstates-class-action-3172725/#:~:text=On%20August%2020%2C%202025%2C%20the,(3d%20Cir.%202025).

The views and opinions expressed in this article are my own and do not represent the professional body I am associated with.